80+ pages during the year a company recorded prepayments of expenses 2.2mb solution in Google Sheet format. During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts. At the end of its annual accounting period the company must make three adjusting entries 1 Accrue rent expense 2 Accrue wages expense 3 Adjust the Prepaid Insurance account for expired insurance For each of the adjusting entries 12 and 3. During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts. Read also year and during the year a company recorded prepayments of expenses 1 record salaries expense incurred for which the cash was paid in advance 2 accrue utilities expense and 3 record services revenue earned for which cash will be.

During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts. What are Prepaid Expenses.

Adjusting Entries A Simple Introduction Bench Accounting

| Title: Adjusting Entries A Simple Introduction Bench Accounting During The Year A Company Recorded Prepayments Of Expenses |

| Format: PDF |

| Number of Views: 8141+ times |

| Number of Pages: 311+ pages |

| Publication Date: February 2018 |

| Document Size: 725kb |

| Read Adjusting Entries A Simple Introduction Bench Accounting |

|

During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts.

Prepaid expenses are not recorded on an income statement initially. During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts At the end of its annual accounting period the company must make three adjusting entries. At the end of its annual accounting period the company must make three adjusting entries. During the year Lyle Co. During the year Sereno Co. Instead prepaid expenses are initially recorded on the balance sheet and then as the benefit of the prepaid expense is.

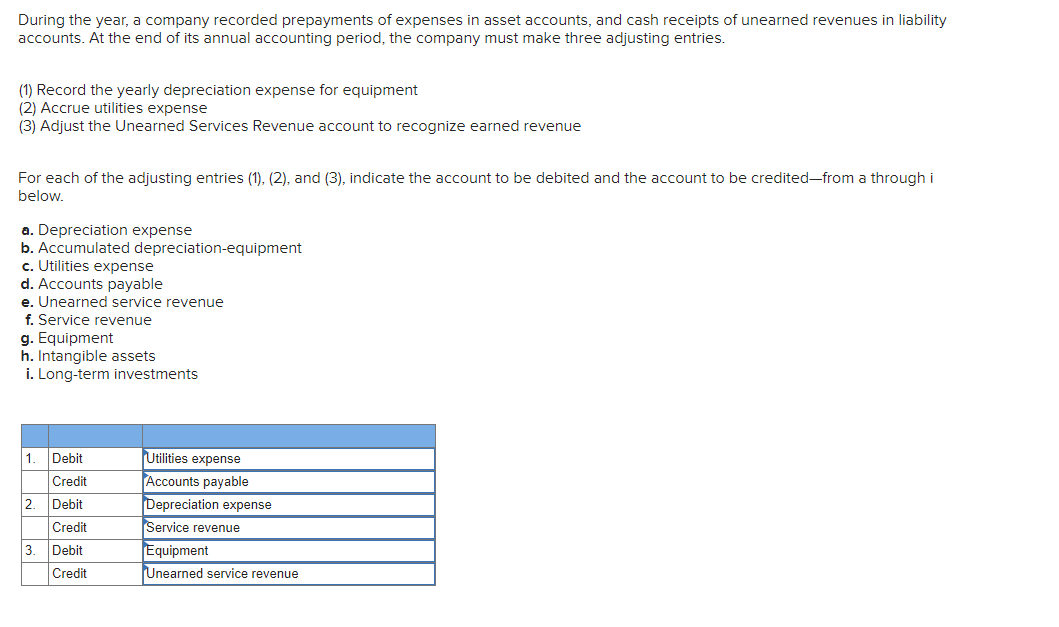

During The Year A Pany Recorded Prepayments Of Chegg

| Title: During The Year A Pany Recorded Prepayments Of Chegg During The Year A Company Recorded Prepayments Of Expenses |

| Format: Doc |

| Number of Views: 3120+ times |

| Number of Pages: 84+ pages |

| Publication Date: April 2019 |

| Document Size: 1.7mb |

| Read During The Year A Pany Recorded Prepayments Of Chegg |

|

During The Year A Pany Recorded Prepayments Of Chegg

| Title: During The Year A Pany Recorded Prepayments Of Chegg During The Year A Company Recorded Prepayments Of Expenses |

| Format: PDF |

| Number of Views: 3180+ times |

| Number of Pages: 9+ pages |

| Publication Date: November 2018 |

| Document Size: 1.6mb |

| Read During The Year A Pany Recorded Prepayments Of Chegg |

|

Worksheet Accounting Terms Part 1 Accounting Is A Piece Of Cake Accounting Basics Learn Accounting Accounting

| Title: Worksheet Accounting Terms Part 1 Accounting Is A Piece Of Cake Accounting Basics Learn Accounting Accounting During The Year A Company Recorded Prepayments Of Expenses |

| Format: Doc |

| Number of Views: 3440+ times |

| Number of Pages: 268+ pages |

| Publication Date: February 2019 |

| Document Size: 1.7mb |

| Read Worksheet Accounting Terms Part 1 Accounting Is A Piece Of Cake Accounting Basics Learn Accounting Accounting |

|

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)

How Are Prepaid Expenses Recorded On The Ine Statement

| Title: How Are Prepaid Expenses Recorded On The Ine Statement During The Year A Company Recorded Prepayments Of Expenses |

| Format: Doc |

| Number of Views: 3080+ times |

| Number of Pages: 207+ pages |

| Publication Date: September 2021 |

| Document Size: 1.3mb |

| Read How Are Prepaid Expenses Recorded On The Ine Statement |

|

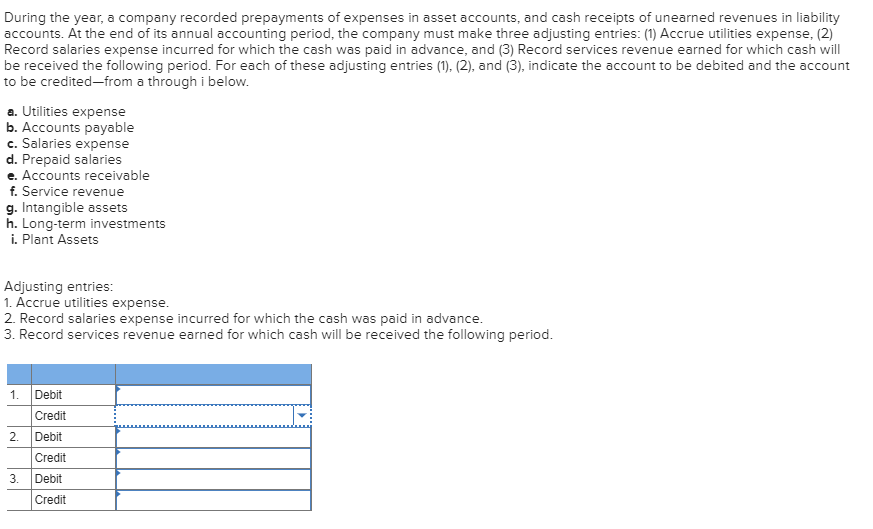

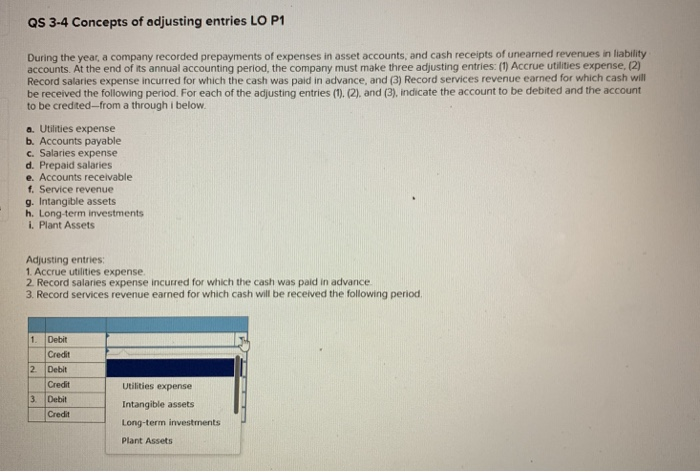

Qs 3 4 Concepts Of Adjusting Entries Lo P1 During The Chegg

| Title: Qs 3 4 Concepts Of Adjusting Entries Lo P1 During The Chegg During The Year A Company Recorded Prepayments Of Expenses |

| Format: Google Sheet |

| Number of Views: 3270+ times |

| Number of Pages: 17+ pages |

| Publication Date: September 2020 |

| Document Size: 3mb |

| Read Qs 3 4 Concepts Of Adjusting Entries Lo P1 During The Chegg |

|

Qs 3 4 During The Year A Pany Recorded Prepayments Of Expenses In Asset Course Hero

| Title: Qs 3 4 During The Year A Pany Recorded Prepayments Of Expenses In Asset Course Hero During The Year A Company Recorded Prepayments Of Expenses |

| Format: Doc |

| Number of Views: 9143+ times |

| Number of Pages: 304+ pages |

| Publication Date: January 2019 |

| Document Size: 1.2mb |

| Read Qs 3 4 During The Year A Pany Recorded Prepayments Of Expenses In Asset Course Hero |

|

Prepaid Expenses Definition Process Blackline Magazine

| Title: Prepaid Expenses Definition Process Blackline Magazine During The Year A Company Recorded Prepayments Of Expenses |

| Format: Doc |

| Number of Views: 7177+ times |

| Number of Pages: 228+ pages |

| Publication Date: February 2018 |

| Document Size: 2.3mb |

| Read Prepaid Expenses Definition Process Blackline Magazine |

|

Acct 304 Final Exam Acct304 Final Exam Latest Spring 2020 2021 Rated 100 Other Students Exam Final Exams Conceptual Framework

| Title: Acct 304 Final Exam Acct304 Final Exam Latest Spring 2020 2021 Rated 100 Other Students Exam Final Exams Conceptual Framework During The Year A Company Recorded Prepayments Of Expenses |

| Format: Google Sheet |

| Number of Views: 6178+ times |

| Number of Pages: 231+ pages |

| Publication Date: February 2017 |

| Document Size: 3mb |

| Read Acct 304 Final Exam Acct304 Final Exam Latest Spring 2020 2021 Rated 100 Other Students Exam Final Exams Conceptual Framework |

|

/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

How Are Prepaid Expenses Recorded On The Ine Statement

| Title: How Are Prepaid Expenses Recorded On The Ine Statement During The Year A Company Recorded Prepayments Of Expenses |

| Format: PDF |

| Number of Views: 3190+ times |

| Number of Pages: 199+ pages |

| Publication Date: December 2021 |

| Document Size: 1.4mb |

| Read How Are Prepaid Expenses Recorded On The Ine Statement |

|

Browse Our Sample Of Texas Promissory Note Template In 2021 Notes Template Promissory Note Templates

| Title: Browse Our Sample Of Texas Promissory Note Template In 2021 Notes Template Promissory Note Templates During The Year A Company Recorded Prepayments Of Expenses |

| Format: PDF |

| Number of Views: 5171+ times |

| Number of Pages: 65+ pages |

| Publication Date: January 2021 |

| Document Size: 1.6mb |

| Read Browse Our Sample Of Texas Promissory Note Template In 2021 Notes Template Promissory Note Templates |

|

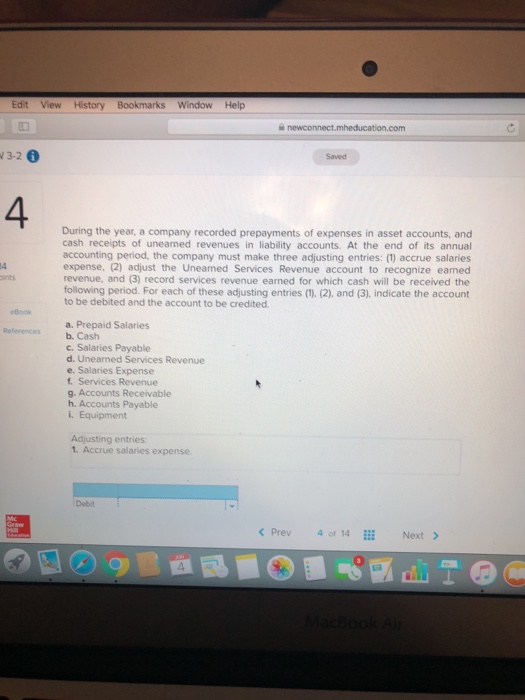

Edit View History Bookmarks Window Help 3 2 6 Saved 4 Chegg

| Title: Edit View History Bookmarks Window Help 3 2 6 Saved 4 Chegg During The Year A Company Recorded Prepayments Of Expenses |

| Format: PDF |

| Number of Views: 3320+ times |

| Number of Pages: 4+ pages |

| Publication Date: August 2018 |

| Document Size: 1.5mb |

| Read Edit View History Bookmarks Window Help 3 2 6 Saved 4 Chegg |

|

During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts. At the end of its annual accounting period the company must make three adjusting entries. 1 Accrue rent expense 2 Accrue wages expense and 3 Record salaries expense incurred for which the cash was paid in advance For each of these adjusting.

Here is all you need to know about during the year a company recorded prepayments of expenses Insurance Expense Asset During the year a company recorded prepayments of. Instead prepaid expenses are initially recorded on the balance sheet and then as the benefit of the prepaid expense is. Recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts. How are prepaid expenses recorded on the ine statement browse our sample of texas promissory note template in 2021 notes template promissory note templates edit view history bookmarks window help 3 2 6 saved 4 chegg how are prepaid expenses recorded on the ine statement prepaid expenses definition process blackline magazine adjusting entries a simple introduction bench accounting During the year a company recorded prepayments of expenses in asset accounts and cash receipts of unearned revenues in liability accounts.

0 Comments